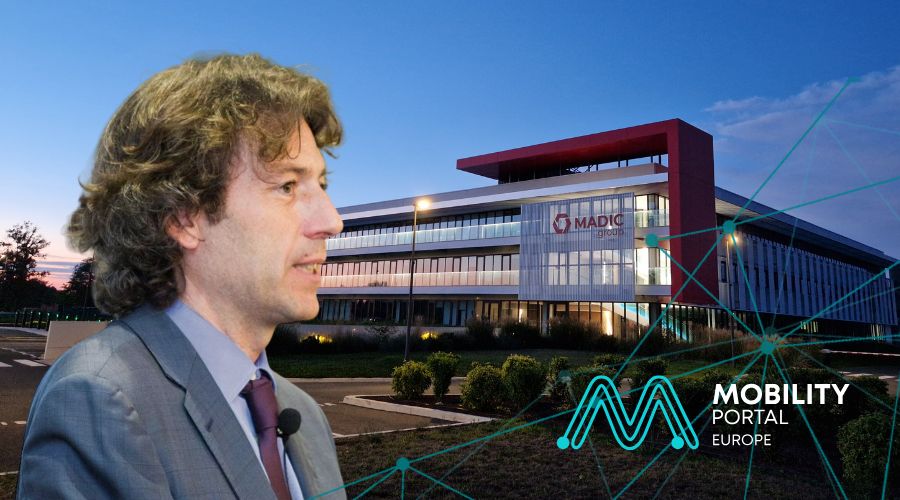

MADIC, an industrial group based in France and present in more than 40 countries, is planning to launch a new fleet charging model before the end of the year under a centralised “power unit” system.

“The goal is to offer a solution that replicates the experience of a petrol station, but adapted to the operational logic of an electric fleet,” explains Jorge Jiménez Suárez, Head of Marketing & Communication at the group.

The new infrastructure will feature a main cabinet that distributes energy to several satellite points, enabling the simultaneous charging of multiple vehicles.

“It’s a technology designed for companies with intensive operations, where every minute counts,” he adds.

Is this launch a coincidence? Absolutely not.

The model responds to the growing demand for specific solutions for logistics operators, public services, and delivery fleet companies.

Electrification in this segment has become one of the main growth drivers for the eMobility market in Europe.

Estimates indicate that corporate fleets represent less than 20% of the total vehicle fleet, but account for over 40% of annual new vehicle registrations, positioning them as a key player not to be overlooked.

And a significant fact: the European Commission is assessing a regulatory proposal that would require companies with more than 100 vehicles to progressively electrify their fleets from 2030.

If approved, it could generate additional demand for more than two million electric units that year.

Although not yet formalised, the initiative is already part of the EU Automotive Industry Action Plan, and has accelerated private operators’ interest in preparing ahead.

As explained by the MADIC Group executive, the solution is still under development.

However, the French company’s ambition is to enter the European market by late 2025 with the commercial launch of this “power unit”.

MADIC Group maintains strong expansion momentum

This development is part of a broader expansion strategy that the group has been strengthening across the continent.

In the past two years, MADIC has invested in new industrial and technological capacity.

“The 18,000-square-metre plant in Bordeaux and the headquarters in Nantes are key to the production and innovation of our new products,” says Jiménez Suárez.

Moreover, the group has acquired small tech companies and suppliers to reinforce its vertical integration.

When speaking about country rankings, the executive highlights that Spain has now positioned itself as the second-largest market in terms of sales volume of charging equipment, just behind France.

MADIC operates in the country through its subsidiary Madic Iberia, which leads installation and maintenance tasks.

He also highlights the contribution of the Catalan delegation 1 Euro, which has helped consolidate regional presence.

As for expectations in Spain, the group is optimistic about what lies ahead.

“We expect 2025 to be better than last year. We have new products approved and adapted to AFIR regulations. Although the start of the year has been slow, we’re confident things will pick up,” confirms Jorge Jiménez Suárez.

And he adds: “The Spanish regulatory framework, which mandates the installation of charging points at fuel stations, was key to the growth.”

The obligation is established by Law 7/2021 on climate change and energy transition, which requires fuel stations with annual sales exceeding five million litres to provide public charging points.

This provision was further detailed in Order TED/1009/2022, which defines the specific thresholds and minimum technical requirements.

According to the order, stations that exceeded ten million litres in 2019 must install at least one 150 kW charging point, while those with sales between five and ten million must have at least one 50 kW charger.

Compliance, however, varies between autonomous communities.

“In the Basque Country, most stations are moving ahead as expected; meanwhile, in Andalusia, many operators haven’t even begun the permit application process,” explains the spokesperson from MADIC.

The company notes that many clients prefer to wait for formal administrative notification before proceeding with installation.

The regulation provides for certain exceptions:

Stations that already have a charger equal to or exceeding the required power, those that demonstrate technical impossibility due to lack of available electrical capacity, or those located within 300 metres of another compliant public charging point are exempt.

MADIC stays ahead of eMobility trends

Since 2022, following the end of its commercial agreement with Alpitronic, MADIC has redefined its product catalogue.

This year, it launched a new line of fast and ultra-fast chargers, ranging from 40 to 400 kW, all AFIR-compliant and equipped with integrated payment terminals (POS).

“The equipment was designed from scratch, based on our field experience. Installing third-party products gave us a very clear picture of the improvements the market needed,” he notes.

A key technical feature of the new models is the inclusion of individual meters per DC outlet.

“This will be a mandatory requirement in the short term, and we wanted to get ahead with solutions that already comply,” explains Jiménez Suárez.

READ MORE

-

Italy welcomes ABB’s new 50 kW charger: First C50 units installed at Il Castagno outlet

The installation, completed in early June, is part of ABB E-mobility’s Early Adopter Program (EAP), a global initiative aimed at gathering real-world insights to refine new products in their intended environments.

-

Safeguard Care: ChargePoint launches service to ensure EV charger reliability

Safeguard Care, combined with ChargePoint Assure, is an ideal solution for charging providers with high traffic and distributed charging stations, such as municipalities, parking garages and workplaces.

-

How AI is optimising the charging of private vehicles and electric fleets in Colombia

Two startups are developing artificial intelligence-based solutions to optimise electric vehicle (EV) charging in cities and along major routes. Consumption forecasting, journey planning, and real-time monitoring are key tools for the efficient use of fleets.