Milence, the joint venture formed by Daimler Truck, TRATON GROUP, and Volvo Group, announced in November 2024 the development of its first national charging hub in Spain.

Specifically, the hub will be located at the Zaragoza Logistics Platform (PlaZa), one of the largest logistics areas in the country, connected to the TEN-T Mediterranean and Atlantic corridors.

With this first hub, Spain becomes Milence’s eighth market, reinforcing its commitment to developing the largest public charging network for heavy electric vehicles in Europe.

The first phase is expected to be operational in the first half of 2025, but Niels Dejonghe, Regional Lead South Europe at Milence, provides further insights in an exclusive one-on-one with Mobility Portal Spain.

The eMobility Conversation:

Why has Milence chosen Spain, and specifically Zaragoza?

PlaZa is one of the largest logistics hubs in Spain and Southern Europe, making it one of the most strategic locations for freight transport.

Additionally, it is well-connected between Barcelona and Madrid, forming one of the largest corridors, including the Mediterranean and Atlantic routes of the TEN-T network.

The strong existing logistics infrastructure there is another key factor, isn’t it?

Absolutely.

Today, it is a major distribution hub for both Spain and Europe.

Many leading logistics companies are also located in PlaZa, further reinforcing our decision.

Have you received support from the local government to carry out this initiative?

Local authorities in Aragón, including Zaragoza, have facilitated the project’s deployment and have been open to discussions.

However, we have not received financial support from the Spanish government.

We have moved forward with our own resources.

How does Milence assess Spain’s competitiveness in terms of policies and subsidies in this sector?

There are incentives for electrification, and interest is very high.

But… Should Spain improve in this area?

Improvements in infrastructure and government support will be crucial for faster adoption.

However, we also recognise that there is room for a new subsidy scheme following the closure of the MOVES-MITMA programme in April 2024.

The subsidy line for purchasing more than 2,000 electric trucks has exceeded available resources, highlighting the need for economic support to facilitate this transition.

How will the integration of this infrastructure with PlaZa’s logistics traffic be coordinated?

The integration of our hub with PlaZa’s logistics traffic is designed to accommodate the projected growth in traffic.

PlaZa continues to expand and has many plans underway, so we want to ensure that the charging infrastructure is ready when needed.

How will you do that?

We anticipate market needs by deploying infrastructure before demand intensifies.

Currently, there is no depot charging available in the area, which is why our charging option is public, meaning any transport operator can access it.

Do you already have initial capacity estimates for the PlaZa charging hub and its scalability potential?

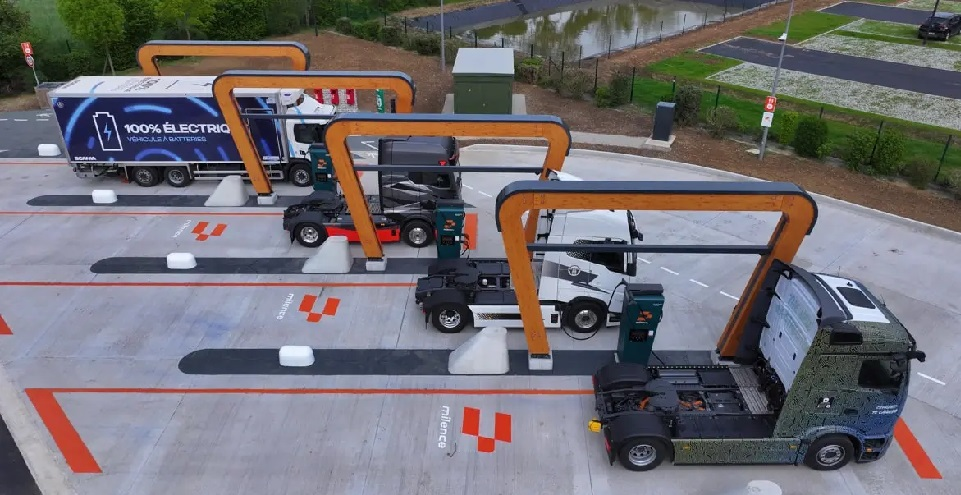

We are starting with four CCS chargers of 400 kilowatts, with four charging bays.

It is a small setup, but it is a good way to begin operations there.

In the second phase, we will add more bays, including the Megawatt Charging System (MCS), which you are surely familiar with.

Additionally, the hub is designed to expand as the demand for heavy-duty electric trucks grows in the future. We want to adapt to the market and grow alongside it.

And specifically, do you already know how many trucks you will be able to serve daily?

That is the big question for everyone in Europe.

Adoption may take some time, as transport companies need time to plan and adjust their routes.

Our hubs in Europe have shown that demand for high-power charging infrastructure for electric trucks is increasing, and interest in Zaragoza is very high.

Being one of the largest logistics platforms in Europe, we anticipate a similar evolution to what we have seen in other markets.

Do you have any examples that could provide estimates?

A perfect example is Venlo, where we launched our hub and have already recorded over 3,000 charging sessions and more than 90 customers in just one year.

Due to growing demand, we had to expand that hub with four additional bays.

This demonstrates that demand cannot always be precisely forecasted, but we want to be ahead of the market to anticipate the demand.

Will storage systems help with these scalability forecasts?

Our hubs source energy from certified renewable sources, which is a fundamental principle for us.

Using batteries in our charging stations will allow trucks to utilise stored green energy, helping to reduce electricity demand peaks and minimise grid congestion.

Are the Milence’s charging prices already defined?

Our standard price is 39 cents per kilowatt-hour, excluding VAT.

This rate applies in all countries where Milence operates and is one of the most competitive on the market.

Are there any variations?

If users utilise an MESP card from a mobility partner, the rate and conditions may vary depending on the provider.

What types of companies are most interested?

Companies like Amazon, which has acquired a significant number of electric trucks, and major players in the logistics sector have already been pioneers in adopting electric vehicles for their fleets.

Companies such as DHL and OEMs are also investing heavily in the development and deployment of electric trucks.

We are also seeing the first players in the Fast-Moving Consumer Goods (FMCG) industry moving in this direction, as well as more initiatives from freight operators.

Read more:

-

Legislative Boost: Poland to Amend the Law on Electromobility and Alternative Fuels

In a key step towards promoting electric vehicles, the Polish government is discussing a draft bill to amend the Law on Electromobility and Alternative Fuels. What will it consist of?

-

EU Car Output Could Rebound to Post-2008 Peak If 2035 Clean Vehicle Target Is Maintained

The report models the impact of maintaining the EU’s zero-emissions target for 2035 and implementing new industrial policies to boost domestic EV production — such as electrification targets for corporate fleets and support for EU-made cars and batteries.

-

Energie 360° acquires Move Mobility, raising Swiss charging points to over 24,000

The takeover of Move Mobility adds 4,700 charging points, increasing the total to more than 24,000 public and private devices across all Swiss regions. The group now operates the most extensive network across all parts of the country.