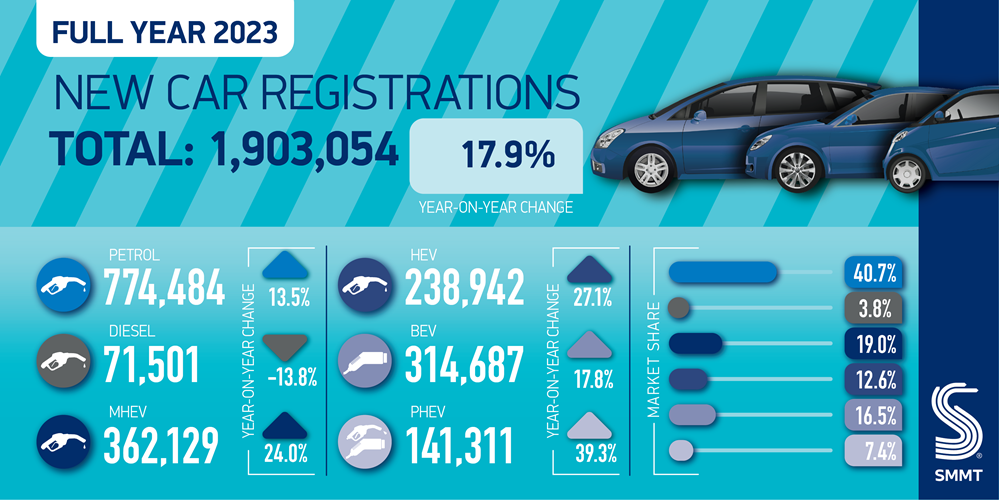

The UK’s new car market has achieved its best year since 2019, with 1.903 million vehicles registered in 2023, marking a significant 17.9% increase, according to the latest data from the Society of Motor Manufacturers and Traders (SMMT).

Despite the market’s continued preference for superminis, dual-purpose, and low-medium cars, electric and low-emission vehicles gained substantial traction.

Hybrid electric vehicles (HEVs) experienced robust growth, surging by 27.1%, capturing a 12.6% market share.

Plug-in hybrid electric vehicles (PHEVs) also had a successful year, with a 39.3% increase in registrations, constituting 7.4% of the market.

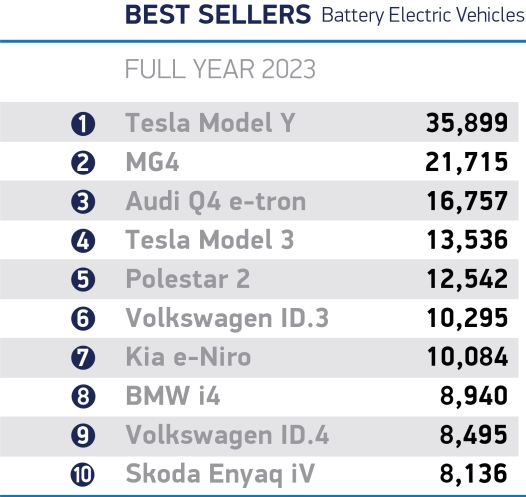

Battery electric vehicles (BEVs) achieved a record volume, with nearly 50,000 more units registered, totaling 314,687 new registrations.

While BEV volumes decreased by -34.2% in the final month of 2023, this was influenced by an abnormal December in 2022, where a significant number of orders were fulfilled.

The industry anticipates potential volatility in the coming months due to regulatory uncertainties, especially the last-minute agreement on origin rules between the UK and the EU, which, while avoiding tariffs on electric vehicles, has introduced planning challenges.

In 2023, BEVs represented one in every six new cars registered, with the majority acquired by fleets benefiting from attractive tax incentives.

In contrast, only one in eleven private buyers opted for a BEV.

The absence of consumer incentives since June 2022 makes the UK the sole major European market without such support.

Industry stakeholders are urging the government to cut the Value Added Tax (VAT) on new BEVs by half for three years, aligning consumer and corporate tax benefits and fostering increased BEV production and adoption.

Over the past five years, BEV adoption has multiplied nearly twentyfold, contributing unexpected VAT gains to the Treasury due to their higher purchase costs.

A 50% VAT reduction is estimated to provide consumers with an additional £7.7 billion in BEV purchasing power by the end of 2026, encouraging 270,000 additional car buyers to choose electric, resulting in 1.9 million new electric vehicles on the road by the end of 2026.

This move would significantly impact the UK’s carbon footprint, reducing road vehicle emissions by over five million accumulated tons over the next three years.

Mike Hawes, CEO of SMMT, commented, “As vehicle supply challenges subside, the new car market is recovering with its best year since the pandemic. Fueled by fleet investments, particularly in electric vehicles, the challenge for 2024 is achieving an eco-friendly recovery.”

“The UK government has set the world’s boldest transition timeline for the automotive sector and is investing to ensure we become a major electric vehicle manufacturer. Now, it must assist all drivers in embracing this future, with incentives for consumers that will make the UK the leading European market for Zero Emission Vehicles (ZEVs),” he said.

Looking ahead to 2024, the latest market outlook, published in November, predicts the new car market to reach 1.97 million units, with 439,000 BEVs holding a market share of 22.3%.

The next revised quarterly outlook will be released in February.