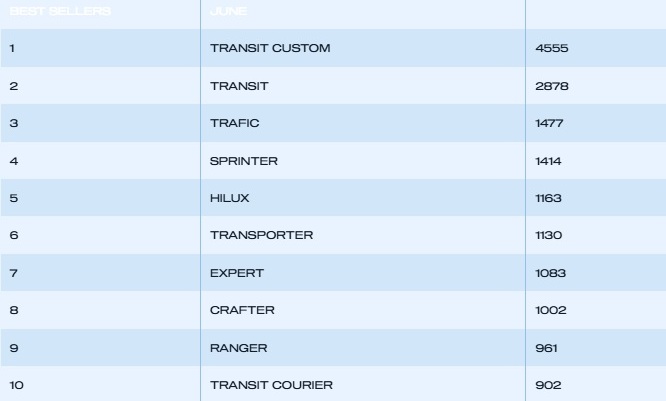

Manufacturers continue to invest massively in cutting-edge zero emission light commercial vehicles (LCVs) and there are now almost 40 different battery electric van (BEV) models to choose from – up from 28 in the first half of last year.

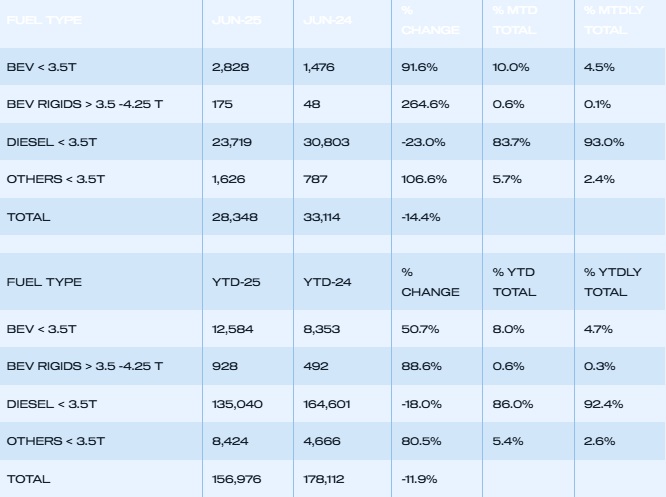

The market is responding, with BEV demand up 52.8% and 13,512 units registered in 2025, boosted by a 97.0% jump in deliveries in June.

In the year to date, new BEV purchases remain at just 8.6% of the overall market, however, little more than half the 16% share mandated by government for 2025 with substantial ground to make up in the second half of the year – a gap which government must help to plug.

The Plug-in Van Grant remains a lifeline for industry, so the sector awaits further details of the ongoing support announced in the Comprehensive Spending Review.

Many businesses are still being held back, however, by a lack of access to suitable commercial vehicle charging at public, depot and shared hub locations.

Market regulation is only workable if sufficient operators can switch so government must ensure greater access to LCV-suitable infrastructure across the country.

Preferential treatment for depot grid connections is also a necessary step, given some sites could face waits of up to 15 years, and consistent and efficient implementation of local planning policy would give fleets the confidence they need to transition their operations to zero emissions.

Mike Hawes, SMMT Chief Executive, says: “Decarbonisation remains a shared ambition but with the EV market more than a third below this year’s target, bold measures are needed to drive demand,”

“Accelerated EV infrastructure rollout, quicker grid connections and streamlined planning are now critical,” he adds.

Van market down every month in first half of 2025 in the UK

New LCV registrations shrank by -12.1% to 156,048 units in the first half of 2025, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

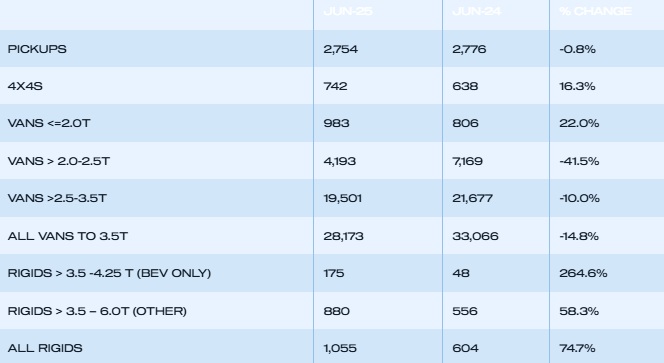

With a -14.8% drop in June, the market declined for the seventh consecutive month, rounding off the worst opening half-year performance since 2022 amid a tough economic environment and weak business confidence to invest in fleet renewal.

Year-to-date performance was led by declining demand for the largest vans, by -14.8% with 99,790 registered, as well as deliveries of medium sized vans, down -20.9% to 26,408 units.

4×4 uptake also fell, by -6.0% to 4,041 units.

“Half a year of declining demand for new vans reflects a difficult economic climate and weak business confidence and the fact that this downturn comes just as industry invests heavily to expand its zero emission LCV offering is particularly concerning,” states Hawes.

There was growth, however, in demand for small vans, up 30.7% to 4,907 units, but could not soften the overall market decline as a lower volume segment.

There was also robust uptake of new pickups in the half-year period, up 10.0% to 20,902 units, however, that obscures two consecutive months of decline following April’s introduction of new fiscal measures to treat double cabs as cars for benefit in kind and capital allowance purposes.

The change in treatment is putting additional costs on key business sectors, constraining new orders of the zero and lower emission models which are entering the market, and keeping more polluting vehicles on the road for longer.

The change will also reduce total tax revenues given the lower registration volumes.

SMMT continues to urge government to postpone the measure for at least one year so that industry and operators can better plan and prepare for the change.

READ MORE

-

Atlante y su “modelo híbrido”: generación, almacenamiento y recarga ultrarrápida para un sistema más resiliente

Atlante acelera su despliegue en España y en diálogo con Mobility portal, Inés Mackey, Chief of Staff de Atlante Iberia define las prioridades de la empresa y su apuesta por la interoperabilidad de la mano de Charge League.

-

Spain Auto 2030: a point-by-point look at the plan set to redefine the eMobility landscape

Spain has entered a new phase in its industrial strategy for electric mobility. The Government has unveiled Spain Auto 2030, a roadmap designed to mobilise €30 billion over the next five years, reshaping the centre of gravity of the electric vehicle market through fresh incentives, a centralised management model, targeted investment in charging infrastructure and…

-

EMT Madrid licita 120 nuevos buses eléctricos: inversión de 79,35 millones y entregas entre 2026-2027

Con esta incorporación, Madrid refuerza su estrategia de descarbonización y consolida una de las flotas eléctricas urbanas más grandes de Europa.