Italy currently has at least 64,300 public charging points, distributed across 33,400 stations in 22,000 locations.

The territorial expansion is undeniable, but it also highlights a persistent technological shortfall: only 16.1% of chargers support fast charging—defined as 50 kW or higher—in direct current (DC).

Most of the network still relies on alternating current (AC) infrastructure, suitable for long charging sessions in urban or residential areas.

As of April 2025, 75% of the installed charging points in Italy operate on AC, typically delivering power levels between 7.4 and 22 kW.

This setup may be appropriate for overnight charging or low-intensity use, but does it meet the needs of commercial fleets, logistics operators, or long-distance mobility?

Industry sources consulted by Mobility Portal Europe in southern Europe point out that the market is already showing clear signs of a transition towards DC charging technologies.

One infrastructure deployment expert in the region stated: “The future lies in intensive use of DC chargers due to their ability to deliver fast and ultra-fast charging in high-demand locations.”

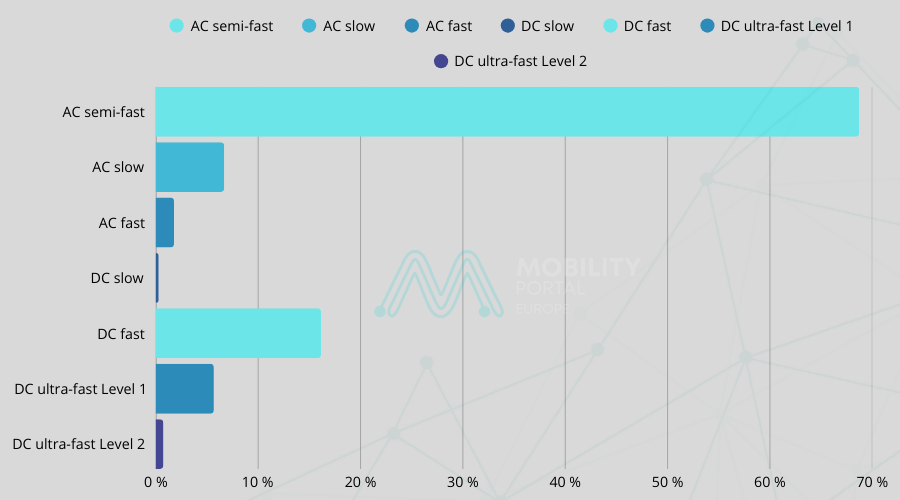

How is the Public Network Distributed by Power?

DC fast chargers (50 to 150 kW) represent 16.14% of the total network. Ultra-fast units—those delivering more than 150 kW—are still marginal: 5.67% fall within the 150 to 350 kW range, and only 0.74% exceed 350 kW.

According to Motus-E data (April 2025), the breakdown is as follows:

- AC semi-fast (7.4 to 22 kW): 68.72%

- AC slow (<7.4 kW): 6.68%

- AC fast (>22 kW): 1.78%

- DC slow (<50 kW): 0.28%

- DC fast (50–150 kW): 16.14%

- DC ultra-fast Level 1 (150–350 kW): 5.67%

- DC ultra-fast Level 2 (≥350 kW): 0.74%

This distribution reflects a strategy focused on territorial coverage, with a heavy reliance on AC charging points, appropriate for urban use and long-duration sessions.

However, sectors requiring high power—such as interurban transport, logistics fleets, and electric tourism—still face structural limitations that hinder operational efficiency.

The lack of high-power charging hubs (above 150 kW) restricts the network’s capacity to keep up with the growing EV fleet and evolving usage patterns tied to long-distance mobility.

The Market Shifts Focus: DC Becomes the Emerging Standard

The main drivers behind this shift are the significant reduction in charging times and improved energy efficiency, both of which are already influencing investment decisions in both public and private sectors.

Another industry insider noted that “certain project tenders still require fixed shares of AC charging, which do not always reflect actual usage patterns.”

From this perspective, the mass deployment of AC infrastructure, common during the early phases of the EV transition, is beginning to show signs of obsolescence.

Today, demand is increasingly oriented toward high-power availability in strategic locations, including national motorways, service stations, logistics hubs, and tourism hotspots.

Manufacturers Adjust Their Technological Offering

This market shift is also evident in the actions of leading charging infrastructure manufacturers.

Companies such as EVBox have restructured their catalogue to focus on DC solutions, prioritising products like the Troniq High Power line, capable of delivering up to 400 kW, designed for high-traffic environments.

Meanwhile, Circutor recently launched its RAPTION 80C, 160C, and 240C range, aimed at fast charging in urban and interurban settings. These chargers can handle simultaneous charging for multiple vehicles and reach up to 240 kW.

On a global level, BYD unveiled its Super e-Platform, an ultra-fast charging system delivering up to 1,000 kW.

Although its initial rollout is limited to the Chinese market, the technology signals a trend that may influence Europe in the coming years, particularly if demand for high-performance infrastructure accelerates.

Fast-Charging Infrastructure Still Lags Outside Major Cities

The deficit in high-power charging infrastructure is especially pronounced outside metropolitan areas.

While regions such as Lazio, Emilia-Romagna, and Campania boast relatively robust networks, interurban corridors, rural zones, and islands remain underserved.

This generates three concrete challenges for battery electric vehicle (BEV) deployment:

- Restricted interurban mobility: Without reliable fast charging on national roads, long-distance EV use is constrained.

- Inefficient fleet operations: Logistics operators struggle to reduce downtime without access to suitable high-power infrastructure.

- Uneven user experience: Consumer confidence depends on charging times that compete with traditional refuelling.

Between Policy and Market Forces: Who Will Drive the Shift?

According to industry sources, despite rapid technological evolution, there remains a strong institutional preference for AC charging, which served its purpose during the early stages but now falls short of current needs.

“The future is in DC charging above 30 kW, yet public administrations still rely heavily on AC,” one expert observed.

In this context, Italy’s challenge lies in aligning public incentives with actual market demands, promoting the deployment of infrastructure that not only expands geographically but also guarantees charging speed and efficiency.