Shares of Stellantis, the automotive giant that owns brands such as Fiat, Peugeot, Jeep, and Citroën, fell by 8.3% on Monday during the opening of European markets.

The company’s stock is now trading at €11.5 per share, marking a significant decline following the announcement of CEO Carlos Tavares’ resignation.

So far in 2024, Stellantis has accumulated a 45.6% loss on the Milan and Paris stock exchanges, where it is listed. Its market capitalisation currently stands at €34.76 billion.

Ahead of Wall Street’s opening, where the group also trades, this announcement adds further pressure to what has already been a challenging year for the company.

Leadership Transition at Stellantis

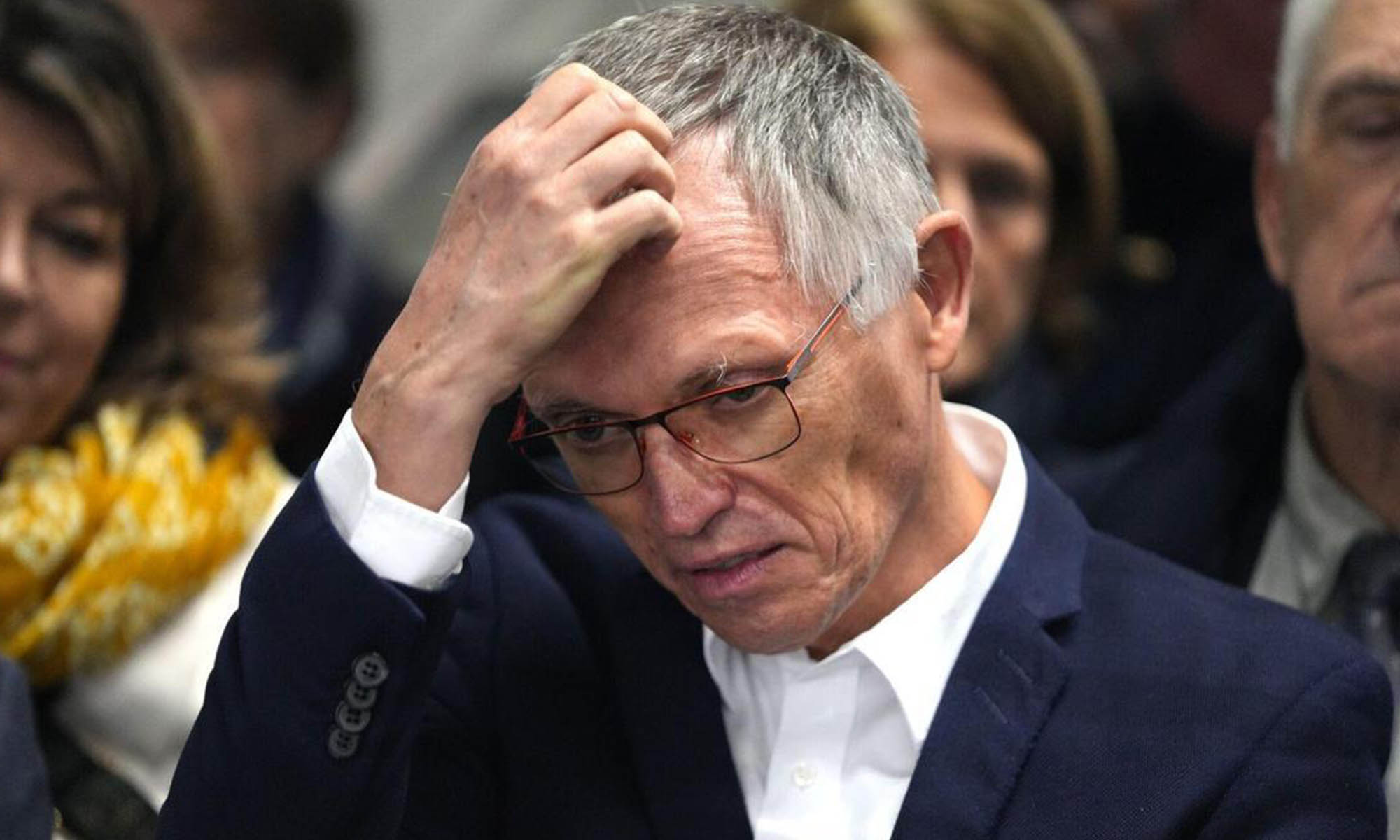

On Sunday, Stellantis issued a statement confirming the resignation of Carlos Tavares, who had held the position of CEO since the group’s formation in 2021, following the merger between Groupe PSA and Fiat Chrysler.

The Board of Directors, chaired by John Elkann, has initiated a process to appoint a permanent CEO, expected to conclude in the first half of 2025.

In the interim, an Executive Committee led by Elkann will oversee the group’s strategic operations.

The resignation follows months of speculation. In October, Stellantis confirmed it was seeking a successor for Tavares, whose contract was set to expire in 2026.

According to internal sources, pressure on the CEO had increased due to challenges in key markets such as the United States and Europe.

Stellantis’ Challenges in a Difficult Market

Stellantis’ performance has been impacted by declining demand for electric vehicles in Europe, alongside difficulties in meeting the European Union’s stringent CO2 emission targets. Additionally, governments such as Italy’s, led by Giorgia Meloni, have exerted pressure on manufacturers to boost local production and reduce emissions.

While Stellantis has announced advancements, such as a strategic partnership with Chinese manufacturer LeapMotor to market electric vehicles in Europe, the group continues to face a tough market. These internal and external tensions culminated in Tavares’ decision to step down.

Henri de Castries, Stellantis’ senior independent director, stated in the release that “different views between the Board of Directors and the CEO” led to this decision. Meanwhile, John Elkann expressed gratitude to Tavares for his role in the creation and consolidation of Stellantis as a global leader in the automotive industry.

Financial Forecasts Remain Unchanged

Despite the uncertainty, Stellantis reaffirmed its financial projections announced on 31 October for the end of 2024. This includes its commitment to maintaining profitability targets and global expansion plans, despite recent leadership changes.

The impact of Carlos Tavares’ resignation and the transition to new leadership will be critical for Stellantis’ future. With over 14 brands in its portfolio and a strategy focused on electrification and expansion into emerging markets, the group faces one of the most decisive moments since its inception.